Hydrogen startups are widely seen as a promising way to eliminate fossil fuels from heavy industry and long-haul transportation. But they have been stuck in limbo for the last couple years, waiting for official guidance from the U.S. Treasury on lucrative tax credits.

The wait ended today, with the Treasury announcing final rules for hydrogen producers to qualify for tax credits under the section 45V of the Inflation Reduction Act.

“We’re grateful to have a final rule,” Beth Deane, chief legal officer at Electric Hydrogen, told TechCrunch. “Without that, the industry is just kind of dead in the track.”

The rules, which have been over two years in the making, relax some parts of the draft proposal, giving existing nuclear and fossil fuel power plants a bit of a reprieve.

Because hydrogen can be made in so many different ways, the resulting rules are a complex maze of regulations designed to ensure that hydrogen producers receiving the credit aren’t inadvertently causing more pollution.

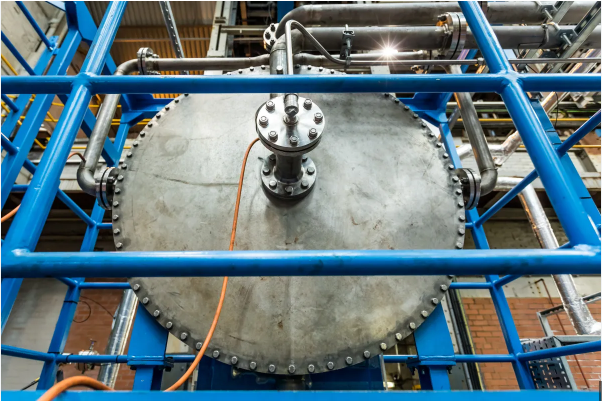

There are two main sources of hydrogen: that which is produced by electrolyzers, which use electricity to split water molecules into hydrogen and oxygen, and that which is generated by steam reformation, which uses steam and heat to break methane molecules, producing hydrogen and carbon dioxide.

But both of those have myriad variations. Steam reformation can dump carbon dioxide pollution to the atmosphere (producing so-called grey hydrogen in the process) or it can capture and store it (blue hydrogen). Electrolyzers can be powered by renewable energy (green hydrogen) or nuclear power (pink hydrogen). If you really want to dig deep, there are so many flavors of hydrogen that people often refer to them all as the hydrogen rainbow.

At its core, the 45V rules seek to ensure that new hydrogen production doesn’t result in additional greenhouse gas emissions on the grid. To do so, the Treasury Department requires producers to track the emissions generated by each kilogram of hydrogen throughout its lifecycle. That means, for example, blue hydrogen producers must account for the planet-warming effects of methane leaks from natural gas pipelines.

Hydrogen producers will have to buy renewable or clean power from the region they’re in. By 2030, they’ll also have to show that power was used to make hydrogen within the hour.

Generally, hydrogen production that generates fewer greenhouse gases throughout its lifecycle gets bigger tax credits, up to $3 per kilogram. Green hydrogen generally costs around $4.50 to $12 per kilogram, according to BloombergNEF, so the maximum credit could make the process competitive with fossil-derived hydrogen in some regions.

Nuclear and fossil fuel power plants also benefit under the revised guidance. Previously, hydrogen producers would have been required to source power from new nuclear plants to qualify. Now, existing nuclear plants can supply up to 200 megawatt-hours of electricity. Also, certain fossil fuel power plants that have recently installed carbon capture equipment will now qualify.

The rules, while welcome, still aren’t perfect. Given the number of interested parties, that’s not surprising. From Electric Hydrogen’s point of view, Deane would like to see some more flexibility around where producers are allowed to buy electricity and how much additional clean or renewable power they’re required to procure.

The US Department of the Treasury and the Internal Revenue Service (IRS) have released the highly anticipated hydrogen tax credit rules, providing clarity for startups and established companies alike. The guidelines, which were mandated by the Inflation Reduction Act (IRA), offer a comprehensive framework for claiming tax credits for hydrogen production, nuclear power, and carbon capture.

Background: The Inflation Reduction Act

The IRA, signed into law in August 2022, aims to reduce greenhouse gas emissions and promote clean energy technologies. The legislation includes a range of tax incentives, including the hydrogen tax credit, to encourage the development and deployment of low-carbon energy solutions.

Hydrogen Tax Credit Rules: Key Provisions

The hydrogen tax credit rules provide clarity on the eligibility criteria, application process, and credit amounts for hydrogen production. The key provisions include:

1. Eligibility Criteria: The rules specify that hydrogen production facilities must meet certain eligibility criteria, including a minimum production capacity and a maximum carbon intensity threshold.

2. Application Process: The guidelines outline the application process for claiming the hydrogen tax credit, including the required documentation and timelines.

3. Credit Amounts: The rules specify the credit amounts for hydrogen production, which range from $0.60 to $3.00 per kilogram of hydrogen produced, depending on the production method and carbon intensity.

Startups and Established Companies: Benefits and Opportunities

The hydrogen tax credit rules provide clarity and opportunities for both startups and established companies. Some of the benefits and opportunities include:

1. Increased Investment: The clear guidelines and attractive credit amounts are expected to increase investment in hydrogen production, driving growth and innovation in the industry.

2. Competitive Advantage: Companies that can demonstrate compliance with the eligibility criteria and application process may gain a competitive advantage in the market.

3. Job Creation and Economic Growth: The growth of the hydrogen industry is expected to create new job opportunities and drive economic growth, particularly in regions with existing energy infrastructure.

Boosting Nuclear and Carbon Capture

The hydrogen tax credit rules also provide a boost to nuclear and carbon capture technologies. The guidelines include provisions for:

1. Nuclear-Powered Hydrogen Production: The rules allow for nuclear-powered hydrogen production to be eligible for the tax credit, providing a new revenue stream for nuclear power plants.

2. Carbon Capture and Utilization: The guidelines include provisions for carbon capture and utilization (CCU) technologies, which can convert CO2 into valuable chemicals and products.

Implications and Future Outlook

The hydrogen tax credit rules have significant implications for the energy industry, startups, and established companies. Some of the key implications and future outlook include:

1. Growth of the Hydrogen Industry: The clear guidelines and attractive credit amounts are expected to drive growth and innovation in the hydrogen industry.

2. Increased Adoption of Low-Carbon Technologies: The rules provide a boost to nuclear and carbon capture technologies, which are critical for reducing greenhouse gas emissions and meeting climate goals.

3. Job Creation and Economic Growth: The growth of the hydrogen industry and the adoption of low-carbon technologies are expected to create new job opportunities and drive economic growth.

Conclusion

The hydrogen tax credit rules provide clarity and opportunities for startups and established companies, driving growth and innovation in the hydrogen industry. The guidelines also provide a boost to nuclear and carbon capture technologies, which are critical for reducing greenhouse gas emissions and meeting climate goals. As the energy industry continues to evolve, the hydrogen tax credit rules will play a critical role in shaping the future of low-carbon energy solutions.

The Hydrogen tax credit rules provide numerous benefits for startups, nuclear, and carbon capture industries. Here are some of the key advantages:

Benefits for Startups

1. Clarity and Certainty: The tax credit rules provide clarity and certainty for startups, enabling them to make informed investment decisions and plan for the future.

2. Access to Capital: The tax credits can help startups access capital, reducing the financial risk associated with developing and deploying new hydrogen technologies.

3. Competitive Advantage: Startups that can demonstrate compliance with the tax credit rules may gain a competitive advantage in the market, attracting investors and customers.

4. Job Creation and Economic Growth: The growth of the hydrogen industry is expected to create new job opportunities and drive economic growth, particularly in regions with existing energy infrastructure.

Benefits for Nuclear

1. New Revenue Streams: The tax credit rules provide nuclear power plants with new revenue streams, enabling them to generate additional income from hydrogen production.

2. Improved Competitiveness: The tax credits can help nuclear power plants improve their competitiveness, reducing the cost of hydrogen production and making it more attractive to customers.

3. Increased Utilization: The tax credit rules can encourage nuclear power plants to increase their utilization, generating more electricity and hydrogen while reducing waste and emissions.

4. Support for Advanced Nuclear Technologies: The tax credits can support the development and deployment of advanced nuclear technologies, such as small modular reactors and integral pressurized water reactors.

Benefits for Carbon Capture

1. Increased Adoption: The tax credit rules can encourage the adoption of carbon capture technologies, reducing greenhouse gas emissions from industrial sources and promoting a low-carbon economy.

2. Improved Competitiveness: The tax credits can help carbon capture technologies improve their competitiveness, reducing the cost of capture and storage and making it more attractive to customers.

3. New Revenue Streams: The tax credit rules provide carbon capture technologies with new revenue streams, enabling them to generate additional income from the sale of captured carbon dioxide.

4. Support for Advanced Carbon Capture Technologies: The tax credits can support the development and deployment of advanced carbon capture technologies, such as direct air capture and afforestation/reforestation.

Benefits for the Environment

1. Reduced Greenhouse Gas Emissions: The tax credit rules can encourage the adoption of low-carbon technologies, reducing greenhouse gas emissions and promoting a low-carbon economy.

2. Improved Air Quality: The tax credits can support the development and deployment of technologies that improve air quality, reducing the negative impacts of air pollution on human health and the environment.

3. Conservation of Natural Resources: The tax credit rules can encourage the conservation of natural resources, reducing the demand for fossil fuels and promoting sustainable energy development.

Conclusion

The Hydrogen tax credit rules provide numerous benefits for startups, nuclear, and carbon capture industries, as well as the environment. By providing clarity and certainty, access to capital, and competitive advantages, the tax credit rules can encourage the adoption of low-carbon technologies, reduce greenhouse gas emissions, and promote a low-carbon economy.